ebike tax credit status

Electric motorcycles already receive a 10 federal tax credit but that figure was tripled to 30 in the new bill according to the Washington Post. This credit amount would be doubled in the case of a joint tax return where two family members purchased eBikes.

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Jimmy Panetta to introduce the Electric Bicycle Incentive Kickstart for the Environment E-BIKE Act which would create a tax credit that covers 30 of the cost of an electric bike up to 1500.

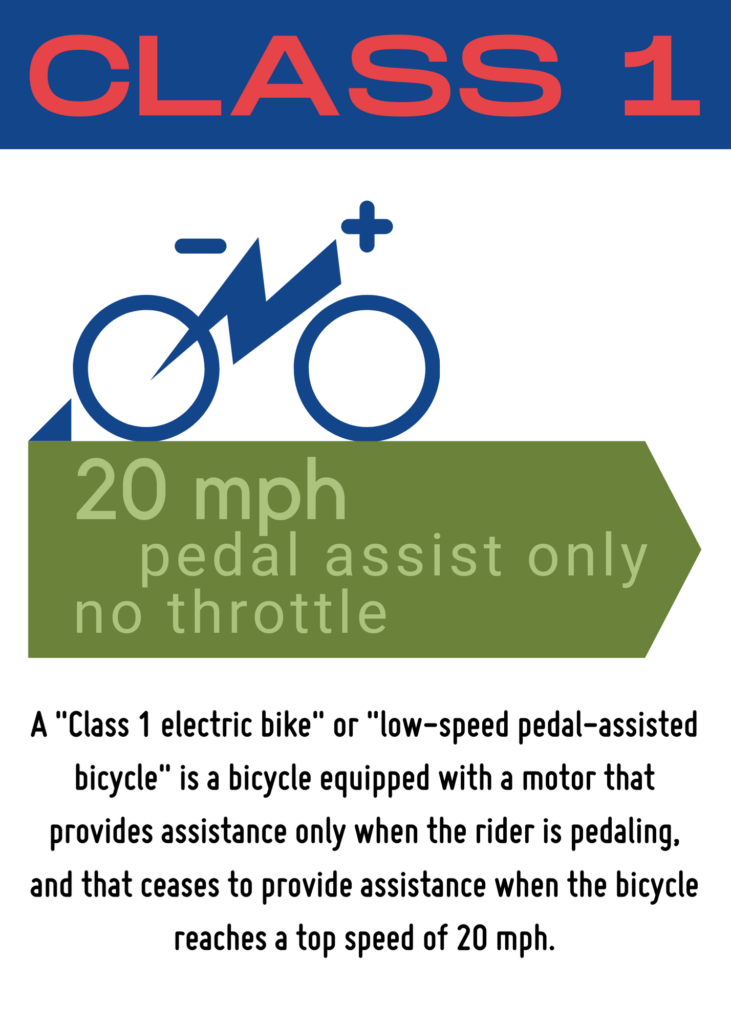

. A Class 1 2 or 3 e-bike purchase qualifies for the credit. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file.

Much like the House bill which Rep. That means there are other bills with the number HR. Class 1 2 and 3 electric bikes of a value of up to 8000 qualify for the credit.

All three e-bike classes would be eligible for the tax credit but bikes with motors more powerful than 750W would not. Lawmakers clearly see e. B Limitation.

Bills numbers restart every two years. Additional 100 rebate with proof of purchase from a bike store located within the CCCE service area. The credit would be available to.

A taxpayer may claim the credit for one. This tax credit is an essential step toward recognizing e-bikes as a crucial green transportation option. The credit has a limit of 1500 or 30 of the total cost whichever is less.

50 up to 500 e-bike rebate 75 up to 1000 for low income For CCCE residential electrical service customers. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. Opened November 9 2021.

The credit was capped at a maximum of 7500. The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500. E-BIKE Act Specifics and Challenges.

This means you can buy an electric bike costing as much as 5000 or more to get the full 1500 credit. This is not a motorcycle this is an e-bike. The incentive can be applied to Class 1 2 or 3 e-bikes priced between 1000 - 4000.

The maximum price of the e-bike must be 8000 or less. The rebate is raised to 300 for low-income households. The credit was restored to 30 percent.

The legislation would offer Americans a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500. The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in.

The maximum dollar amount for the tax credit is 1500. Electric Bike Tax Deduction Info. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. Electric bike models that are priced at 8000 or less would qualify for the proposed tax credit. As part of Bidens Build Back Better bill individuals who make 75000 or less qualify for the maximum credit of up to 900.

The proposed tax incentive detailed in the E-BIKE Act would give taxpayers who purchase an e-bike up to 30 back of the retail price in the form of a tax credit. NHTSA considers limiting speeds on new cars California considers 2500 tax credit for non-car owners and Ford finally gets it. The credits also phase out according to household income.

Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act This bill allows a refundable tax credit for 30 of the cost of a qualified electric bicycle. Earl Blumenauer sponsoring a bill with Rep. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each.

As stated you might get up to a 1500 credit to defray 30 of the cost of an electric bike. For those who make less than 75000 as an individual or 150000 as joint filers purchasing an e-bike could get. The incentives had been proposed to go as high as 12500 on new cars and up to 4000 on used electric vehicles.

And potentially even more importantly these tax credits will be refundable. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. On the Federal level theres momentum for incentives like this as well with Portlands Rep.

Contra Costa County - Adult 18 residents can apply for a 150 rebate towards the purchase of any ebike ebike conversion kit or electric moped. Jimmy Panetta D-CA introduced in February Schatz and Markeys proposal would offer Americans a refundable tax credit. Ad Aprio performs hundreds of RD Tax Credit studies each year.

The E-BIKE Act creates a credit against your federal taxes of up to 1500 per taxpayer. Class 1 2 and 3 e-bikes are eligible. 1 2026 and to 18 on Jan.

See here for program details. A 30 percent tax credit for new e-bike purchases made it into the White Houses Build Back Better legislation as the 175 trillion budget deal nears the. 1019 is a bill in the United States Congress.

A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Robert on 40-year old man riding ebike killed in San Clemente hit-and-run.

The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000. The credit would be fully refundable which would allow lower-income individuals to claim it. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States.

The credit is limited to 1500 per taxpayer less all credits allowed for the two preceding taxable years. This credit would be available to all e-bike purchasers regardless of socioeconomic status a common divider in tax credit bills. Architecture Construction Engineering Software Tech More.

A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year. This is the one from the 117 th Congress. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit.

The credit can go toward purchasing one new e-bike with a price tag of 8000 or less. New E Bike Act Introduces 30 Us Federal Tax Credit For Electric Bicycle Purchases Electric Bicycle Bicycle Ebike Any American who makes 75000 or less qualifies for a credit of up to 900 on one bike. The law has not yet been passed as of August 2021 but if approved it would allow 30 with a total limit up to 1500 to be refunded per taxpayer on the purchase of an e-bike.

This tax credit would be wonderful news to avid e-bikers and new riders alike.

Let S Pass The E Bike Act Rei Co Op

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

Denver Launches Nation S Best E Bike Rebate Program

New E Bike Act Introduces 30 Us Federal Tax Credit For Electric Bicycle Purchases Electric Bicycle Bicycle Ebike

Wing Launches New Freedom X A Stylish E Bike At A More Budget Friendly Price Bike Ebike New Freedom

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

What Makes A Good Electric Bike Incentive Program Peopleforbikes

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

Electric Bicycle Incentives Go Local Peopleforbikes

Electric Bicycle Incentives Go Local But Feds Can Do More Streetsblog Usa

Ebike Classifications And Laws San Diego County Bicycle Coalition

Understanding The Electric Bike Tax Credit

Ebike Rebates And Incentives Across The Usa

About Us Gocyclemarine Com The Most Innovative Lightweight Folding Bike For Yachting Enthusiasts Folding Bike Folding Electric Bike This Is Us

Schwinn Ec1 Cruiser Style Electric Bicycle 26 In Wheels 7 Speeds Blue Walmart Com In 2022 Best Electric Bikes Electric Bike Bicycle